The Ultimate Guide to: Building Safety Act Budgets

Intro

“We don’t know where to begin!” is one of the responses we often hear when asking owners of high-risk buildings how they are budgeting for costs associated with complying with the Building Safety and Fire Safety Acts.

Organisations such as local authorities, housing associations, care home providers and developers are legally obligated to comply with the Acts. Still, compliance costs vary massively depending on the size and complexity of their building portfolios and the quality of the information they currently possess about them.

“We should write a guide on this to help!” is the most common retort from the Operance team. But as we found out very quickly when trying to do just that, it’s not easy! I actually started and paused this process many times, going as far back as January, to help organisations develop their budgets before the usual March/April switchover. But alas, here I am in March, desperately trying to provide something that may be at least useful with final budget checks before approval!

I even reached out to the industry to see if any organisations were willing to share some of their own experiences and information that we could deliver to the masses in the spirit of helping the rest of the industry. Unfortunately, this bore very little fruit. In hindsight, given that we are now in March, these same organisations are probably still madly trying to finalise their budgets or, perhaps, are too shy to share their findings because they, too, are still uncertain as to whether they have indeed covered everything.

This, I believe, is the point that will hopefully become clear through this guide; unless you have a magic crystal ball, you won’t be able to accurately budget for every possible item, occurrence, effort and cost associated with complying with building and fire safety ‘to-the-pound’.

Quite frankly, we don’t yet know what we don’t yet know! Or to put it more eloquently…

“There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don’t know. But there are also unknown unknowns. There are things we don’t know we don’t know” – Donald Henry Rumsfeld, American politician.

So, what can you expect from this guide if this is the case? Well, we decided it was best to do the following;

-

Provide researched guidance to help organisations cast a final eye over their final budget drafts.

-

Stick to what we know, don’t worry about what we don’t know, and don’t be afraid of gaps; we can fill them and re-release the guide again later as we learn more.

-

Stick to the guidance. If it is a legislatively prescribed item, list it. If it’s not, don’t, but explain why so the reader is clear, as this will help with known misconceptions.

-

Stick to ‘items’ and stay clear of actual ‘costs’. Even if we had some examples of costs, we would still need to consider the buyer and seller’s geographics and procurement strategies.

-

Stick to post-remedial works. Plenty of articles are available by others covering the ACM scandal and the cost and effort required to rectify issues, so we will concentrate on the costs associated with defining, curating, accessing and maintaining the golden thread of information.

With this in mind, here we go; here are what we believe to be the most frequently asked questions about budgeting to comply with building and fire safety acts, such as;

Why?

Why do we need to budget for complying with the Building Safety Act?

It depends entirely on your CEO’s appetite to visit His Majesty’s judicial facilities…or worse.

The Building Safety Act (and various related Acts) aim to improve building safety standards, particularly in residential high-rise buildings. Housing associations in the UK must develop and maintain a golden thread of information for all buildings within their portfolios that are over 18 meters tall or contain seven storeys or more.

Implementing these regulations can come at a cost, and building owners may need to invest in upgrades and improvements to ensure compliance.

Compliance with the Act involves a range of measures, including building safety assessments, appointing a building safety manager, and creating and maintaining a digital record of building information, i.e. the Golden Thread.

Non-compliance with building safety regulations can severely affect the Principal Accountable Person, individuals and the community. If you do not comply with building safety regulations, you may face legal consequences such as fines or legal action.

Additionally, suppose you are responsible for the construction or maintenance of a building. In that case, non-compliance with building safety regulations can result in the building being deemed unsafe or uninhabitable, leading to the closure or condemnation of the building.

In the event of a building accident or disaster, such as a fire or collapse, non-compliance with building safety regulations can significantly harm the occupants of the building, neighbouring properties, and the surrounding community.

It is important, therefore, to take building safety regulations seriously and ensure that all necessary measures are taken to comply with them to ensure that buildings are constructed and maintained in a way that minimises the risk of harm to the occupants and the surrounding environment.

Why do we need to budget for complying with the Fire Safety Act?

The Fire Safety Act, introduced in 2020, places additional responsibilities on building owners to ensure the safety of occupants in the event of a fire. Unlike the Building Safety Act, this legislation applies to all buildings, not just high-rise residential buildings.

Building owners will need to carry out regular fire risk assessments, identify and address any potential hazards, and ensure that occupants have a clear means of escape in the event of a fire.

While these regulations are undoubtedly necessary, complying with them can be expensive. Building owners may need to invest in building structure upgrades, such as installing sprinkler systems or improving fire-resistant cladding. They may also need to invest in new technology, such as fire alarms or smoke detectors, and train staff on how to respond in an emergency.

In addition to the direct costs of implementing these regulations, building owners may also face indirect costs. Compliance with the Building Safety Act and Fire Safety Act may increase insurance premiums, for example, as insurers want to ensure that buildings are as safe as possible. This could be particularly problematic for owners of older buildings, who may need to carry out significant upgrades to comply with the new regulations.

Despite these costs, building owners have a legal and moral obligation to ensure the safety of their occupants. Failure to comply with these regulations could result in significant financial penalties or criminal charges. Moreover, the cost of not complying with these regulations can be far higher in the long run if a fire occurs, resulting in loss of life, injuries or property damage.

In conclusion, complying with the Building Safety Act and Fire Safety Act will come at a cost. Still, it is a necessary investment to ensure the safety of occupants in buildings. Building owners must take the regulations seriously and make the investments required to comply with them. By doing so, they will meet their legal obligations and create a safer and more secure environment for everyone who uses their building.

Why is it so difficult to budget for?

Accountable and Principal Accountable Persons (PAP) may incur costs related to developing and maintaining the golden thread, such as hiring consultants, developing software or databases, and training staff. These costs may vary depending on the size of the PAP organisation and the complexity of its building portfolio.

As mentioned above, without access to specific financial information from individual housing associations, local authorities or other developers, it isn’t easy to provide a definitive answer on how much they spend on the golden thread. Therefore evidence or guidance is, at the moment at least, in short supply. Consequently, the opportunities to learn from others are few and far between. So, in essence, everyone is in the same boat at the moment; they’re all learning on the job.

What?

What should we allow for in our budget to comply with the Building and Fire Safety Act?

Ahh, the big question itself!

By carefully assessing your needs and only including costs directly related to compliance with the Building Safety Act, you can create a more accurate budget and ensure that you are not unnecessarily inflating your costs. But, as these costs can vary depending on the type and size of the building, the current state of its fire safety measures, and the specific requirements of the regulations, we are going to shy away from providing actual cost suggestions and instead offer some potential costs to consider:

Building Safety

The proposed reforms include new safety requirements. You will therefore need to budget for the cost of these safety measures, which may include the hiring of additional staff or contractors to carry out safety inspections and remediation work. Examples include;

-

HRB Registration: Applying for registration of a higher-risk building and any resubmissions following any changes in the future will incur a fee.

-

BAC Certificate: Applying for a building assessment certificate could include a fee. There will also be a cost in displaying a building assessment certificate regarding labour and materials.

- Developer Levy: The levy would be paid by developers of new high-rise buildings and would be based on the size and value of the building. Whilst it’s clear that a levy will need to be paid, it’s still not entirely clear how much it will cost. The recent Building Safety Levy Consultation is now closed (opened on 22 November 2022, and closed on 7 February 2023), and suggests the fee will be either worked as a cost per unit or cost per metre squared. Whichever rate they go with to start, they government suggest that they will review the rates regularly, possibly every 3 years and will consider adjusting for inflation at the review points as needed.

- Residential Property Developer Tax: The Residential Property Developer Tax is a proposed new tax that was announced by the UK government in the 2021 budget. The tax would be paid by residential property developers who make profits of over £25 million per year. The tax is designed to raise revenue for the government and to encourage property developers to build more affordable homes. The exact amount of the tax has not yet been determined.

- Community Infrastructure Levy: The Community Infrastructure Levy is a proposed replacement for the current system of Section 106 agreements and the Community Infrastructure Levy (CIL). The Infrastructure Levy would be a flat-rate tax on all new developments and would be used to fund local infrastructure projects. The exact amount of the levy has not yet been determined as the legislation is still being drafted.

-

Assessing and Managing Building Safety Risks: Taking reasonable steps to carry out the initial and ongoing regular safety risk assessments will also need to be factored in. Your team could undertake this in-house or externally by a specialist provider. In either case, please remember that whoever carries out these assessments must prove their competencies per the legislation.

-

Upgrades or Remediation Work: If your building is not up to standard, following your building safety assessments, owners may need to invest in upgrades to their fire safety measures to bring it into compliance by making upgrades or renovations, such as; adding/upgrading or installing sprinkler systems, fire alarms, smoke detectors, installing additional fire exits, upgrading the electrical system or fire-resistant cladding. You may add a ‘risk pot’ item within your budget for necessary changes.

-

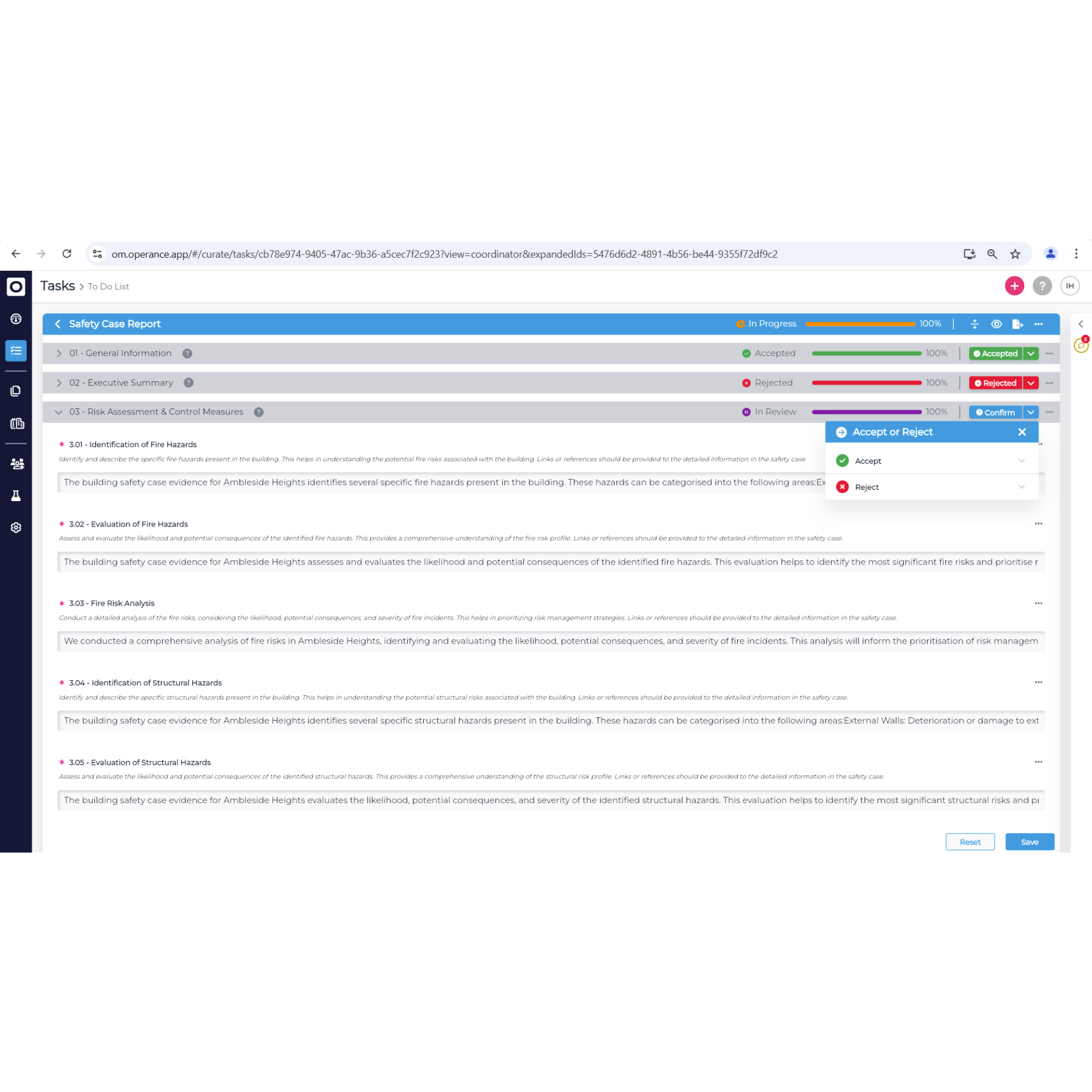

Safety Case and Safety Case Report: The preparation, storage, revising, notifying and provision of a safety case and the safety case report will incur its costs with management and digital platform costs.

-

Golden Thread of Information: As mentioned above, there are costs associated with the general management, creating, updating and storing the prescribed documents on a digital platform such as Operance. But costs here could also involve fees costs related to ‘filling in the gaps’ where information is required but is not available and therefore needs to be provided by either your internal team or external consultants. For example, suppose you have a 30+-year-old building, and you have no evidence of its foundations. In that case, you may need to pay for a consultant to investigate these foundations should you consider them a risk and provide information about them, i.e. trial pit investigations, drawings, and descriptions. These additional costs could rise rapidly if your existing building information is inadequate or simply not existing.

-

Mandatory Occurrence Reporting: establishing and operating a Building Safety Mandatory Occurrence Reporting (BSMOR) system and providing information to the regulator will again involve management and platform costs. BSMOR requires responsible and accountable persons to report specific safety-related incidents and near-misses in their buildings to the Building Safety Regulator. The incidents could include events that could cause or have caused harm to the safety of occupants or other individuals in or around the building, or that could have affected the structural or fire safety of the building. This includes gas leaks, fires, explosions, structural collapses, and serious accidents.

-

Residents’ Engagement Strategy: Preparing, reviewing, and sharing of the strategy. The residents’ engagement strategy is a set of guidelines and principles aimed at ensuring that residents are effectively engaged in improving building safety. The strategy emphasises the importance of clear and transparent communication between building owners, managers, and residents and sets out a framework for engaging with residents throughout the building safety process.

-

Resident’s Voice: The proposed reforms aim to give residents a more significant say in the management of their homes, such as by establishing a new national tenant voice and the requirement for landlords to have a resident engagement strategy, as mentioned above. You may need to allocate resources to support resident engagement and empowerment initiatives, such as hiring staff to liaise with residents or providing training and support for resident-led groups.

-

Complaints: establishing and operating a system for the investigation of complaints.

-

Contravention Notices: providing a contravention notice to a resident and applying to the county court could include costs, such as legal advice. This may be required when requesting to enter premises or making an application to the county court for an order requiring that the accountable person be allowed access to premises, for instance.

Fire Safety

The Regulatory Reform (Fire Safety) Order 2005 is the primary legislation governing fire safety in non-domestic premises in England and Wales. The Fire Safety (England) Regulations 2022 amend the Regulatory Reform (Fire Safety) Order 2005 and introduce new requirements for building owners and managers to ensure the safety of people from the risk of fire.

To comply with these specific fire-related legislations, you should allow for the following costs:

-

Fire Safety Equipment: This could include fire alarms, sprinkler systems, smoke detectors, and fire extinguishers. You may also need to hire contractors to install or maintain this equipment.

-

Emergency Lighting: Potentially including additional or replacement exit signs and lighting in stairwells and other emergency exits. Again, you may need a contractor to install or maintain this lighting.

-

Fire Safety Signage: You may need to provide appropriate upgraded/additional fire safety signage throughout your premises, such as fire exit signs and fire equipment signs.

-

Fire Risk Assessments: Your organisation must carry out regular fire risk assessments of your premises and implement any necessary measures to reduce the fire risk. The cost of the fire risk assessment will depend on the size and complexity of your premises and the scope of the evaluation and may also include the cost of hiring external fire consultants. To satisfy the Fire Safety Act, you must carry out the following as a minimum;

-

Communal fire door checks every three months.

-

Internal flat/dwelling fire door checks every twelve months.

-

-

Fire Safety Training: You will need to train your staff on fire safety procedures, such as how to use fire extinguishers, evacuate the building, and raise the alarm in the event of a fire. The cost of providing this training will depend on the number of staff and the specific training required. You may need to hire a consultant or trainer to provide this training.

-

Fire Systems Maintenance and Testing: You must regularly maintain and test your fire safety measures, such as fire alarms, emergency lighting and fire extinguishers, to ensure they are in good working order. The cost of maintenance and testing will depend on the size and complexity of your premises and the specific measures being maintained and tested.

-

Record Keeping: You must keep records of all fire risk assessments, inspections, and testing carried out, as well as any actions are taken to mitigate risks. The cost of record keeping will depend on the size and complexity of the building and the specific requirements of the Fire Safety (England) Regulations 2022.

-

Secure Information Box (SIB): A secure and fire-resistant box or cabinet that must be installed near the main entrance or in another prominent location in multi-occupied residential buildings. The box is intended to provide a safe and secure location for storing fire safety information and is easily accessible to fire and rescue services in case of an emergency. The SIB must contain important fire safety information, including a copy of the latest fire risk assessment, emergency fire evacuation plan, and other relevant information. It must be clearly labelled with the building’s address and additional relevant identifying information. It must be securely fixed to the structure and be easily accessible to fire and rescue services at all times. The box must be fire-resistant and able to withstand exposure to fire and heat for a certain period of time, typically at least 30 minutes. The Secure Information Box aims to ensure that critical fire safety information is readily available to fire and rescue services in case of an emergency, which can help improve the safety of occupants and minimise the risk of damage to the building.

Compliance and Governance

There are various other additional costs associated with general compliance and governance that you may wish to consider, and these could include;

-

Social Housing (Regulation) Bill: This proposed bill also includes additional requirements for social housing providers to comply with, such as publishing annual reports on their performance and having a clear system of accountability and governance. You may need to allocate resources to ensure you have the necessary systems and processes to comply with these requirements.

-

Building Inspections: You should budget for regular inspections of your building to ensure it is up to code and compliant with safety regulations. You may need to hire a third-party inspector to conduct these inspections.

-

Staff Training and Recruitment: Whilst the Building Safety Act no longer makes the Building Safety Manager a mandatory requirement, the importance of someone taking on the responsibilities of this role is still massively essential to your organisation. Therefore you may factor in training and recruitment for those responsible for overseeing the safety of the building and ensure they have the necessary skills and knowledge to comply with the new regulations.

-

Legal and Administrative Fees: Building owners may need legal advice or hire administrative support to help with the compliance process and documentation.

-

Insurance: You should budget for either upgrading or obtaining new insurance policies that meet the required standards and cover fire damage and liability in case of a fire or other safety incident. Existing insurance premiums may increase as insurers want to ensure that buildings are as safe as possible.

Digital transformation

The proposed reforms include a focus on using technology to improve the efficiency and transparency of social housing management, such as using digital tools to communicate with residents or monitor building safety. You may need to allocate resources to invest in new technology and systems to support these initiatives, such as Operance, the world’s first purpose-built golden thread platform.

Complying with the Building Safety Act will require various digital transformation requirements, and prioritising these requirements will depend on your specific situation and needs. However, some of the key digital transformation requirements that you may want to consider prioritising include the following:

-

Defining Your Exact Information Requirements: Platforms such as Operance have an in-built interface to develop your own ‘Data Templates’. These are critical to ensuring your organisation creates a unique set of requirements that are uniform across every building within your portfolio, both old and new. Costs involved here include digital services consultants to help you develop your initial set of data templates. Our Head of Digital Services, Dave Peacock, would be more than happy to help you with an idea of costs for this; contact him at dave.peacock@operance.app.

-

Curating Your Digital Information: With your Data Templates and organisational requirements in place, you need a platform such as Operance to help semi-automate the collection of this digital information and to store it at the ‘elemental level’ it is associated with. This is a key recommendation of Building A Safer Future, the resulting report from Dame Judith Hackitt’s investigation into the Grenfell disaster. Your teams mustn’t rely on PDFs stored within a generic filing system such as a Common Data Environment (CDE) or a standard Dropbox-like system. Costs for curating your information for new build or refurb projects currently in the Design and Construction stages should be offset by the project costs themselves, but be warned, your project team probably did not have the exact information requirements at the start to request the complete set of information, so there may be additional costs involved, but again, at the project level. Operance can help here by providing a guide on costs for our information managers to help coordinate the information you need for both new and old facilities. Contact our Chief Sales Officer, Ian Hetherington, at ian.hetherington@operance.app.

-

Accessing and Sharing of Your Digital Information: Information collected must be easily accessible for all those needing access, such as building owners, operators, occupants, residents, local emergency services, local authorities and of course, the Building Safety Regulator. This can easily be forgotten when being seduced by impressive 3D model-type environments when looking to procure a ‘golden-thread’ solution. The issue here is that not everyone is comfortable navigating a complicated 3D model to find the information they need to understand how safe your building is, particularly when sharing information with residents. A platform such as Operance provides easy access to anyone that needs it to find the information they need in a simple interface which they are used to in everyday life, such as finding films on Netflix or music on Spotify. Contact our Chief Sales Officer, Ian Hetherington, at ian.hetherington@operance.app for a guide on these costs and an idea as to how our costs compare against other said solutions.

-

Maintaining Your Digital Information: This is the most crucial part of the golden thread requirements. There is little to no benefit in producing information if you are not going to keep it up to date across the lifecycle of the building. To do this effectively, your full set of digital information should be the same set as, or at least fully integrated, with your facilities and asset management information. This is a big part of your single source of truth. If this is the case, you can provide a full lifecycle history of every component of your building, providing accountability and transparency of the decisions made, by whom and when. Contact our Chief Sales Officer, Ian Hetherington, at ian.hetherington@operance.app for a guide on these costs also.

-

Digitising Existing Building Safety Information: The Building Safety Act requires building owners to maintain and provide detailed information about their existing buildings, including fire and structurally related components, to the Building Safety Regulator. Digitising this information can help make it more accessible and easily updated, reducing the administrative burden on building owners. Should your information be found but provided in paper form, Operance can help with this too. Contact our Chief Sales Officer, Ian Hetherington, at ian.hetherington@operance.app for a guide on how we digitalise paper and can store it within the golden thread to the latest ISO19650 standards.

-

Implementing Digital Inspection and Reporting Tools: The Building Safety Act will require more frequent and detailed inspections of high-risk buildings, and digital inspection and reporting tools can help streamline this process. These tools can enable inspectors to capture and share information in real time, reducing the need for manual data entry and improving accuracy.

-

Enhancing Collaboration and Communication Tools: The Building Safety Act requires building owners, residents, and other stakeholders to work together to ensure building safety. Digital collaboration and communication tools can facilitate this collaboration and make it easier to share information and updates in real time.

-

Adopting Data Analytics and Predictive Maintenance Tools: Digital tools such as data analytics and predictive maintenance can help identify potential risks and maintenance needs before they become significant issues. These tools can help building owners prioritise maintenance and repairs, reducing costs and improving safety.

-

Improving Cybersecurity Measures: As digital tools become more central to building safety compliance, it is essential to ensure that your organisation has appropriate cybersecurity measures to protect sensitive information and systems.

Prioritising these digital transformation requirements can help you comply with the Building Safety Act more effectively and efficiently while improving overall building safety. However, it is essential to work with qualified professionals to develop a comprehensive digital transformation strategy that is tailored to your specific situation and needs. Contact our Head of Digital Services, Dave Peacock, for an idea of costs: dave.peacock@operance.app.

Miscellaneous Costs

There are bound to be costs that we have missed here or that we simply are unaware of, given the complexity of the subject and depth of requirements. Here we list any other items that we have been made aware of that you may want to consider;

-

Potential Business Interruptions: Compliance may require temporary closures of parts of the building or disruptions to operations, which could impact revenue.

-

Professional Consultancy: It is recommended that you work with a qualified professional or consultant to assess your situation and develop a detailed budget and plan for compliance with the Social Housing White Paper, a policy paper the UK government published in November 2020. It sets out a range of proposed reforms to improve social housing in the country. It was intended to address some key challenges facing the social housing sector, such as the shortage of affordable homes, poor quality housing, and a lack of tenant engagement.

What shouldn’t we allow for in our budget to comply with the Building and Fire Safety Act?

When budgeting to comply with Building and Fire Safety Act, it is essential to avoid including costs that are not directly related to compliance or that may not be necessary for your specific situation. Some examples of expenses that you should not have when budgeting for compliance with the Building Safety Act include:

-

Costs for Unrelated Building Upgrades: While compliance with the Act may require some building upgrades, ensuring that any enhancements you undertake are directly related to compliance is essential. Including costs for unrelated upgrades may inflate your budget unnecessarily.

-

Unnecessary Consultant Fees: While engaging consultants to ensure compliance with the Act may be necessary, it is essential to assess your needs carefully and only hire necessary consultants. Including unnecessary consultant fees in your budget can significantly increase your costs.

-

Unnecessary Technology Investments: While digital transformation is an essential part of complying with the Act, it is important to carefully assess your needs and only invest in technologies necessary for compliance. Including unnecessary technology investments in your budget can significantly increase your costs.

-

3D Scanning and BIM Models: The Act does not explicitly require using 3D scanning and Building Information Modeling (BIM) models. However, these tools can help comply with the requirements of the Act, particularly for high-rise and complex buildings. BIM models can help improve collaboration and coordination between stakeholders and provide a detailed digital representation of the structure, including information on fire safety systems and structural elements. This can help ensure that the building is designed, constructed, and maintained to meet the requirements of the Act. 3D scanning can also be helpful in identifying potential risks and defects in existing buildings. Creating a detailed digital model of the building, including any hidden structural elements, can identify and address potential issues before they become major safety risks. While the use of 3D scanning and BIM models is not required by law, they can be valuable tools in complying with the requirements of the Act and improving building safety overall. Working with qualified professionals to assess your situation and determine the most appropriate digital tools for your needs is important.

-

Costs for Compliance with Other Regulations: While complying with the Act may require some overlap with other regulations, such as the Fire Safety Act and the Social Housing Bill, it is essential to carefully assess which costs are specifically related to compliance with the Act and exclude expenses that are related to compliance with other regulations such as;

-

CDM 2015: The Construction (Design and Management) Regulations (CDM) 2015 set out the UK’s health and safety requirements for construction projects. Therefore, in developing your annual organisational budget, you should only account for these costs in project-specific budgets. Having said that, if you are a client or principal contractor, and you do need to develop a project budget, you will need to budget for the following costs to comply with the CDM Regulations as a minimum:

-

Appointing a CDM advisor or coordinator: You will need to appoint a competent person as a CDM advisor or coordinator to advise you on health and safety matters during the project. This may be an internal staff member or an external consultant. The cost will depend on the complexity and size of the project.

-

Developing a construction phase plan: You will need to establish a project plan outlining the health and safety risks and how they will be managed. The cost of developing this plan will depend on the size and complexity of the project.

-

Providing health and safety information to contractors: You will need to provide relevant health and safety information to the contractors working on the project. This may include site plans, risk assessments, and method statements. The cost of developing and providing this information will depend on the size and complexity of the project.

-

Ensuring that contractors comply with the CDM Regulations: You will need to monitor the health and safety performance of the contractors and ensure that they comply with the CDM Regulations. This may involve additional staff time or hiring external consultants to conduct inspections and audits.

-

Training and awareness: You will need to provide relevant training and awareness to staff and contractors on the health and safety requirements of the CDM Regulations. This may include training on risk assessments, method statements, and the use of personal protective equipment. The cost of providing this training will depend on the size and complexity of the project and the number of staff and contractors involved.

-

-

Building Regulations: As with CDM 2015, these need only apply on a project-by-project only basis, meaning these costs should get picked up in specific budgets for new build and refurbishment projects. However, it may help to understand what these include too. So, to comply with the Building Regulations, you should allow for the following costs in your budget as a minimum:

-

Planning and design: You will need to plan and design your building to meet the requirements of the Building Regulations, including ensuring compliance with structural, fire safety, ventilation, energy efficiency, and accessibility standards. The cost of planning and design will depend on the size and complexity of the building and the specific requirements of the Building Regulations.

-

Building materials and construction: You must use appropriate building materials and construction methods to ensure compliance with the Building Regulations. This may include insulation, fire-resistant materials, damp-proofing, and soundproofing. The cost of building materials and construction will depend on the size and complexity of the building and the specific requirements of the Building Regulations.

-

Building control inspections: You must have your building inspected by a building control officer at various stages during the construction process to ensure compliance with the Building Regulations. The cost of inspections will depend on the size and complexity of the building and the number of inspections required.

-

Planning fees: You may need to pay planning fees to your local planning authority for the submission of planning applications and building control applications. The cost of planning fees will depend on the size and complexity of the building and the specific requirements of the planning authority.

-

Certification and testing: You may need certification and testing to demonstrate compliance with the Building Regulations. This may include obtaining an energy performance certificate, air pressure testing, and sound insulation testing. The cost of certification and testing will depend on the size and complexity of the building and the specific requirements of the Building Regulations.

-

NEWSLETTER

Revolution Is Coming

Subscribe to our newsletter so we can tell you all about it.

You can unsubscribe at any time and we don’t spam you.